Montana car insurance requirements include minimum liability coverage of 25/50/10—$25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage.

These limits are the legal minimum needed to drive in the state, but they may not fully protect you in a serious accident. Optional coverages, such as collision, comprehensive, rental reimbursement, and GAP insurance, can provide added financial security.

Montana Car Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

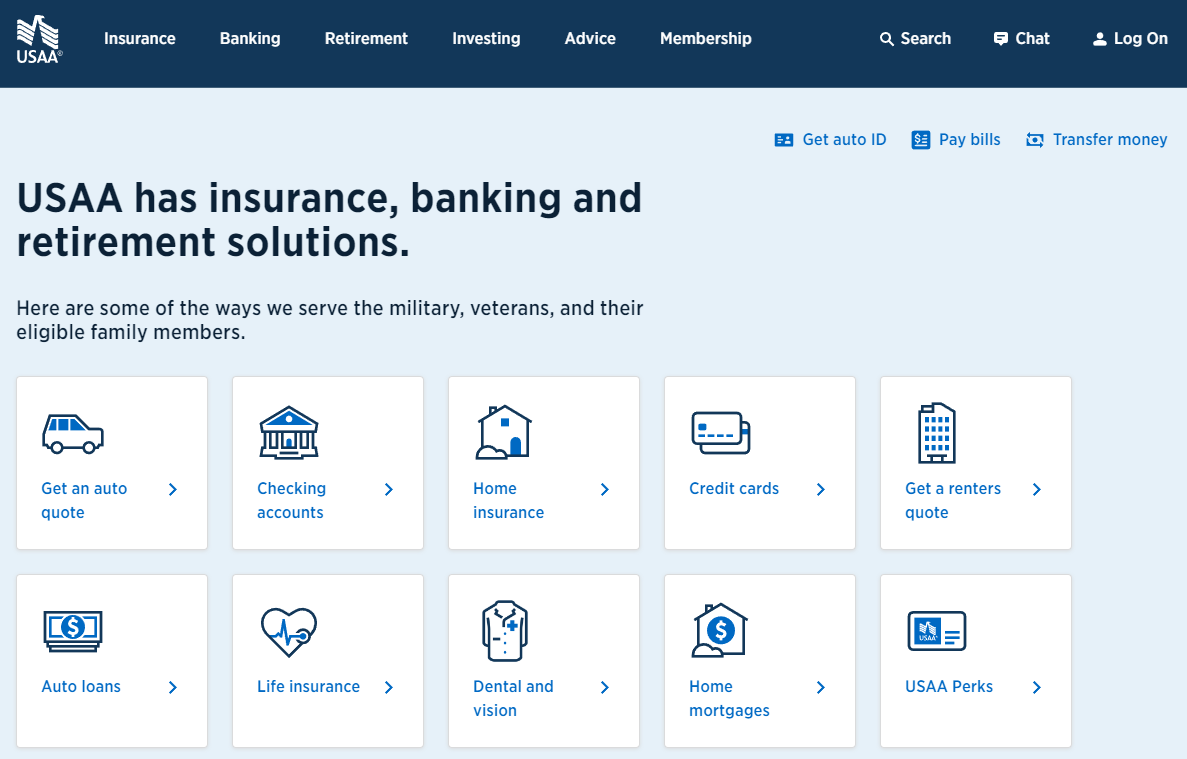

Montana drivers pay an average of $716 annually, but rates vary by age, driving record, and location. USAA offers the cheapest coverage starting at $14 per month, followed by other competitive providers. Your car’s make and model, usage, and credit history also affect your premium.

- Montana car insurance requirements mandate 25/50/10 liability coverage limits

- Minimum coverage may not fully protect against major accident-related expenses

- USAA offers the cheapest Montana car insurance rates, starting at $14 per month

Insurance companies may weigh these factors differently, so comparison shopping is key. To lower costs, ask about safe driver discounts or usage-based insurance programs. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Montana Minimum Coverage Requirements & What They Cover

You may have car insurance, but do you have enough? Montana requires minimum liability coverage of:

- $25,000 for bodily injury per person, per accident

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Montana car insurance requirements set the legal minimum; consider higher limits for added peace of mind.

Read more: What You Need to Know Before Buying Auto Insurance in Montana.

Montana car insurance requirements include 25/50/10 minimum liability. Higher limits and optional coverage offer better protection and reduce out-of-pocket costs after accidents.Laura Berry Licensed Insurance Agent

Montana only requires liability insurance, but state minimums rarely offer complete protection. Consider these optional coverages to reduce out-of-pocket costs after an accident:

- Collision Coverage – Pays for damage if you hit another vehicle or object.

- Comprehensive Coverage – Covers vandalism, animal collisions, theft, and weather damage.

- Towing and Labor Coverage – Pays for towing or roadside assistance after a breakdown or crash.

- Rental Car Coverage – Pays for a rental while your car is being repaired.

- GAP Insurance – Covers the difference between your car’s value and loan balance if totaled.

Read more: The Difference Between Comprehensive and Collision Insurance

Cheapest Car Insurance Options in MT

Montana is the 2nd cheapest state for auto insurance. Drivers pay about $60 per month, with the cheapest rates starting at $14., but some providers offer lower rates.

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Below are average costs from the cheapest companies in Montana:

Cheapest State Minimum Insurance in Montana's

| Insurance Company | Monthly Rate |

|---|---|

| $53 | |

| $57 | |

| $81 |

| $93 |

| $69 |

| $75 | |

| $53 |

| $53 | |

| $56 | |

| $32 |

How car insurance costs determined

Driving a frequently stolen car can raise your car insurance rates. Here are the most stolen vehicles in Montana:

- Chevrolet Pickup (Full Size)

- Ford Pickup (Full Size)

- Honda Accord

- Dodge Pickup (Full Size)

- GMC Pickup (Full Size)

- Chevrolet Pickup (Small Size)

- Chevrolet Impala

- Toyota Camry

- Honda Civic

- Subaru Legacy

Liability insurance won’t cover theft. Add comprehensive coverage for protection.

Additional Montana Resources

Frequently Asked Questions

What are Montana’s minimum car insurance requirements?

Montana requires liability coverage with minimum limits of 25/50/20—$25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage per accident.

Is liability insurance sufficient in Montana?

While liability insurance meets legal requirements, it may not fully cover costs in a serious accident. Consider additional coverages like collision, comprehensive, and GAP insurance for better protection.

How much does car insurance cost in Montana?

The average annual cost for car insurance in Montana is approximately $1,615, which is 13.1% higher than the U.S. average.

Who offers the cheapest car insurance in Montana?

USAA provides affordable car insurance in Montana, with minimum coverage starting at $14 per month.

What factors affect car insurance premiums in Montana?

Insurance premiums are influenced by factors such as age, gender, driving record, vehicle type, and credit history.

Can I lower my car insurance rates in Montana?

Yes, you can reduce premiums by maintaining a clean driving record, improving your credit score, and inquiring about discounts for safe driving or bundling policies.

What optional coverages should I consider in Montana?

Optional coverages include collision, comprehensive, rental reimbursement, and GAP insurance, which provide additional financial protection beyond the state minimums.

Do car insurance rates vary by city in Montana?

Yes, rates can vary by location due to factors like local accident rates and repair costs. For instance, Baker has some of the lowest insurance rates in the state.

How do age and gender impact car insurance costs in Montana?

Younger drivers and males typically face higher premiums due to statistically higher risk profiles.

Are there discounts available for drivers with violations in Montana?

Some insurers offer discounts for drivers with violations if they complete defensive driving courses or maintain a clean record for a specific period. Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool.