Smoke Marijuana? Here’s What You Need To Know About Its Impact on Car Insurance Rates.

Long considered by much of American society—and our government—as a total no-no, marijuana is just now starting to lose its taboo label. Today, four U.S. states and the District of Columbiaallow the recreational use of pot. Another 20 states have legalized medicinal use of THC, marijuana’s potent compound, and many pot advocates and political researchers expect these numbers to grow.

As the legalization of marijuana becomes more popular, experts have wondered about the effect this could have on our society, the economy, and various industries. With other industries struggling to catch up to the impacts of marijuana use, we wanted to find out what this means for car insurance. Does marijuana use affect your rates?

There are several factors in play here, so let’s take a look at the data and break down what this means for the future of auto insurance.

The Data: Marijuana Use and Auto Insurance Rates

For our analysis, we looked at two key sources of data. The first is the percentage of Americans who regularly use marijuana. The Washington Post pulled this data from the National Survey on Drug Use and Health. This information is broken down by county to show where in the U.S. people are using more marijuana.

Our second source of information is state Department of Insurance reported auto insurance rates, which we have used throughout obrella.com.

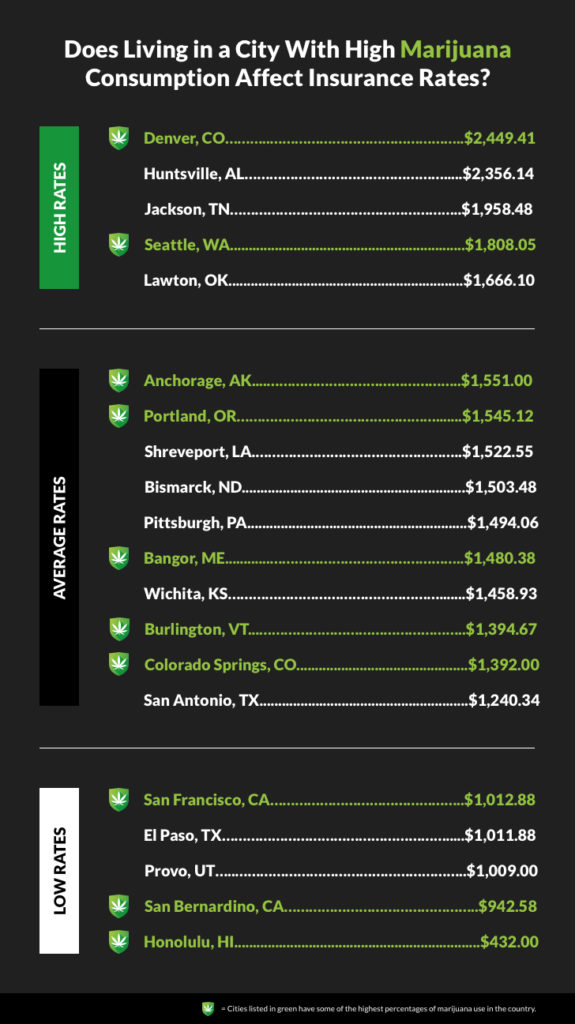

To compare, we looked at the pot-use data, using the largest metropolitan city in large states, or the entire state for some low-population states. We then looked to see if there was a correlation between these high-use areas and high-cost insurance. Here’s what we found:

There is no correlation between marijuana use and car insurance rates.

Let’s go into more detail. Of the five areas with the highest auto insurance cost (listed below), only two (Seattle and Denver) are in the top weed-use category. It is notable that these cities are in states that have legal recreational marijuana. However, three of these expensive areas actually had some of the lowest rates of marijuana use.

Conversely, three of the cheapest areas for car insurance (Hawaii, San Bernardino, and San Francisco) have the highest rates of THC use. (For more information, read our “Finding Affordable Auto Insurance In San Francisco”).

This is why we can say that, according to our research, higher use of marijuana does not seem to lead to more expensive car insurance. But why would this be?

There are a few reasons why there is no current correlation between weed and car insurance. First, there are several factors that go into the total cost of insurance. We wrote about this in detail on our Car Insurance Frequently Asked Questions pages, but here’s the gist.

Insurance companies use several sources of information to set rates. This includes data about whether a particular geographic location is statistically more prone to car accidents. The more likely drivers in an area will crash, the higher that area’s rates tend to be.

If high rates of marijuana use lead to more crashes, we might expect those areas to have more expensive insurance. That leads to this question:

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

What are the effects of marijuana on driving and car crashes?

To find this answer, we looked for reported studies on the issue. In May 2016, The Washington Times reported that in Washington state, which legalized recreational marijuana in 2012, the percentage of drivers who had used pot within hours of a fatal crash had doubled between 2013 and 2014.

This may sound alarming at first. The truth is that it’s nearly impossible to tell whether the drivers in these fatal crashes were actually impaired by the THC they consumed. According to Science Daily, research shows that although blood tests can assess the level of THC in a person’s system, “There is no science showing that drivers reliably become impaired at a specific level of marijuana in the blood. Depending on the individual, drivers with relatively high levels of marijuana in their system might not be impaired, while others with low levels may be unsafe behind the wheel.”

The reality is that even if more drivers happen to have pot in their system after a crash, that doesn’t mean that the marijuana is actually contributing to more accidents.

A factor that does contribute to the cost of car insurance is alcohol. This is particularly true for male drivers, who are statistically more likely to be in alcohol-related fatal crashes. This is because, in contrast to testing for THC, blood-alcohol content (BAC) tests are much more scientifically reliable. Unless marijuana testing becomes more dependable, it seems that alcohol will remain a much bigger factor in car insurance costs.

Car insurance companies are certainly watching closely to see if pot usage may eventually become a relevant factor for setting rates. But it will take more research—and legislation from state governments—before we see any movement on the issue. According to PreciseLeads.com:

“Until legislators determine the actual effects of marijuana and refine legislation to address it, all that insurance agents in legalized states can do is watch and wait as policies develop — advising clients, as always, to drive safe.”

But even though we can’t find any link between marijuana use and average car insurance rates, that doesn’t mean that as an individual, you can’t get into trouble.

Can You Get a DUI for Marijuana Use?

Despite the scientific unreliability of THC blood tests, many states, including some of those that have legalized recreational or medical marijuana, have laws against driving with pot in your system.

This means that in these states, you could be arrested and charged with a DUI for having THC in your blood, even if the marijuana isn’t currently impairing your driving. Having a legal prescription for pot will not exempt you from these laws.

DUIs can dramatically affect your own car insurance. You could receive significant rate increases for several years—up to $1,500 per year in some cases. You could even have your policy canceled by the insurance company. In addition, your state may legally require you to purchase SR-22 coverage to continue driving. This type of coverage is costly and can make the process of shopping for insurance difficult. To be safe, never drive while under the influence of alcohol or any drug.

Our auto insurance resource center can help you learn your state’s requirements for SR-22 coverage. And if you have been arrested for a DUI, you can still compare and shop for affordable auto insurance coverage.

Free Insurance Comparison

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption