Searching for car insurance information that actually pertains to your life? We’ve done all the research and analysis to bring it to you here. If you root for the Browns or Bengals and live in the Buckeye State, this car insurance information is for you.

What Are You Looking For?

- Ohio’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Ohio’s Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What kind of auto insurance coverage do you need in Ohio?

Ohio’s minimum coverage requirements are for bodily injury liability coverage and property damage liability coverage. However, liability insurance only covers other parties’ damages in an accident you cause. To have your own damages covered, you need to add collision coverage and comprehensive coverage to your auto insurance policy.

You might also consider additional coverage options like uninsured/underinsured motorist coverage, GAP insurance, and personal injury protection. GAP insurance helps if you still owe money on your auto loan when your car is totaled, and personal injury protection kicks in when you have expensive medical expenses related to an accident.

Read more:

What are Ohio’s cheapest companies?

We compiled data from 10 cities and eight driver profiles of people with a 2013 Honda Civic LX (4-door), good credit, and no accidents to come up with average annual car insurance premiums for 12 insurance companies in Ohio. American Family only gave us rates for a 60-year old married couple which could be why its premium average is so low. Regardless, take a look to see where the cheapest auto insurance is on average in Ohio.

| Cheapest Companies in Ohio | Average Annual Rates |

|---|---|

| American Family | $585.80 |

| Westfield | $764.93 |

| Erie | $779.30 |

| Nationwide | $1,078.70 |

| Allstate | $1,133.10 |

| Cincinnati Insurance | $1,374.40 |

| Travelers | $1,430.50 |

| Farmers | $1,442.16 |

| Geico | $1,533.90 |

| Liberty Mutual | $1,623.65 |

| Grange Mutual | $1,781.65 |

| Motorists Mutual | $2,370.05 |

How much do drivers like you spend on auto insurance?

If you don’t fall into the “average” category, take a look at the data below. We calculated rates by driver type to give you a more accurate picture of what your Ohio car insurance coverage could cost you.

Cheapest For Teen Drivers

After running the numbers for teen boys and girls who were 18-years old, here is where we found the cheapest rates:

| Females' Rates | Males' Rates | |

|---|---|---|

| Erie | $1,368.80 | $1,571.20 |

| Nationwide | $2,062.40 | $2,235.20 |

| Allstate | $2,092.80 | $2,246.40 |

| Liberty Mutual | $2,604.00 | $3,999.60 |

Cheapest For Teen Boys And Girls

On average, teenage boys will pay about 23% more for auto coverage in Ohio. It’s because of the statistics that indicate higher accident rates with male teen drivers. Nevertheless, you can look at the chart below to see where male and female teenagers can find the cheapest auto coverage in Ohio.

| Females' Rates | Males' Rates | |

|---|---|---|

| Erie | $1,368.80 | $1,571.20 |

| Nationwide | $2,062.40 | $2,235.20 |

| Allstate | $2,092.80 | $2,246.40 |

| Liberty Mutual | $2,604.00 | $3,999.60 |

Cheapest For Young Drivers

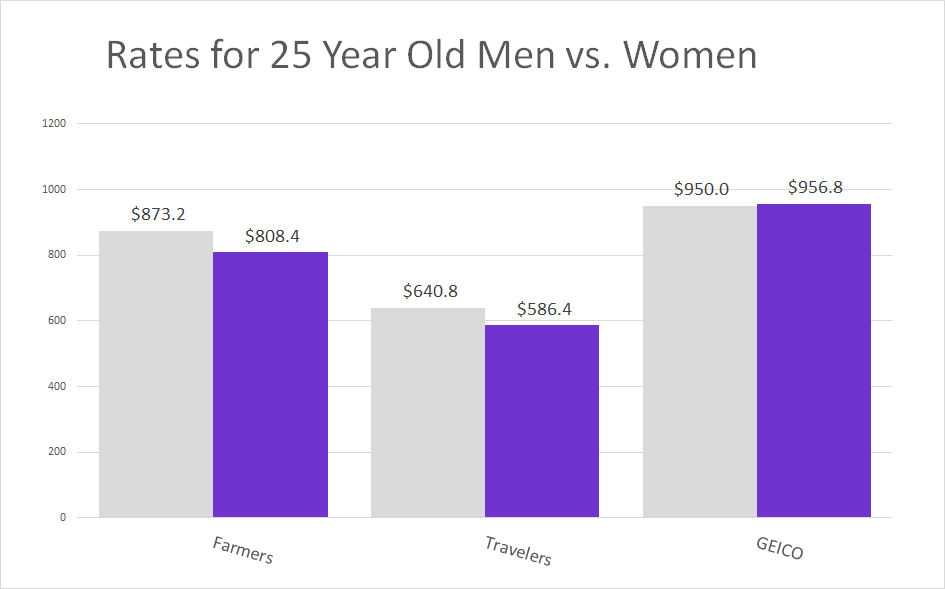

Based on the profiles of 25-year old men and women, we were able to determine the cheapest rates on average. Here they are:

| Average Annual Rates | |

|---|---|

| Travelers | $613.60 |

| Erie | $643.20 |

| Allstate | $837.60 |

| Farmers | $840.80 |

| Nationwide | $869.60 |

| Geico | $953.40 |

| Westfield | $964.00 |

| Liberty Mutual | $1,249.60 |

| Grange Mutual | $1,273.40 |

| Motorists Mutual | $2,098.40 |

How Rates Fluctuate By Age And Gender

Your personal information affects your car insurance premium. From 18 to 25, men will see a 70% drop in insurance premiums. In the second chart, you can see how women’s rates drop about 65% between the same ages. Take a look.

Cheapest For Drivers Over 40

After analyzing data from 40 and 60-year old men and women drivers, we found the cheapest car insurance average premiums for this age group. If you’re in this demographic, check it out.

| Average Annual Rates | |

|---|---|

| Erie | $502.00 |

| Farmers | $559.50 |

| American Family | $585.80 |

| Travelers | $586.70 |

| Nationwide | $648.20 |

| Westfield | $665.40 |

| Allstate | $762.60 |

| Geico | $891.70 |

| Liberty Mutual | $971.60 |

| Grange Mutual | $1,036.30 |

| Cincinnati Insurance | $1,374.40 |

| Motorists Mutual | $1,435.30 |

In addition to age, gender, and marital status, auto insurance companies consider your credit score and driving record when assigning auto insurance rates. If you’re having trouble finding affordable rates because of a poor credit history or a speeding ticket on your driving record, make sure to ask about insurance discounts. Common discounts include the safe driver discount (for staying claim-free), the discount for taking a defensive driving course, and the discount for taking part in a usage-based insurance program. These programs use a mobile app to track your driving habits and you save on your premium by driving safely.

What are average rates in the cities?

Parma is one of the largest suburbs of Cleveland and has rates that are about $400 cheaper than Cleveland itself. Rates aren’t bad in Dayton, Ohio either, at nearly $200 dollars lower than Cleveland. If you live in Ohio, see what your city averages are for car insurance and what your neighbors might be paying.

| Cost of Insurance by City | Average Annual Rates |

|---|---|

| Parma | $1,210.52 |

| Lorain | $1,261.19 |

| Cincinnati | $1,283.12 |

| Canton | $1,304.29 |

| Akron | $1,314.71 |

| Columbus | $1,414.29 |

| Dayton | $1,459.43 |

| Toledo | $1,487.80 |

| Youngstown | $1,508.57 |

| Cleveland | $1,621.61 |

Which Ohio car insurance providers are most popular?

Progressive, Nationwide, and Grange are all headquartered in Ohio which might be a reason why they have so much of the state’s market share the percentage of customers a company has compared to competitors. When you’re choosing an auto insurance provider, see how popular it is in your area. It might give you more confidence if one company has more customers than others.

| Market Share Percent | |

|---|---|

| State Farm | 19.25 |

| Progressive | 12.82 |

| Allstate | 10.34 |

| Nationwide | 9.38 |

| Geico | 5.88 |

| Grange Mutual | 5.4 |

| Liberty Mutual | 4.32 |

| Erie Insurance | 2.89 |

| American Family | 2.78 |

| Westfield | 2.65 |

Which auto insurance companies have the most customer complaints?

A “complaint index” reports the percentage of customers who complain compared to a company’s market share. Companies with low indexes have less complaints and ones with higher numbers need to do a better job with customer service. Pekin is Ohio’s best while Safe Auto has some work to do. Take a look.

| Premiums Written | # Of Complaints | Complaint Ratio | |

|---|---|---|---|

| Pekin Ins | $32,782,381 | 2 | 0.06 |

| Cincinnati Ins. Co | $128,201,019 | 10 | 0.08 |

| Auto Owners Grp | $88,733,841 | 8 | 0.09 |

| Westfield Insurance | $151,880,777 | 14 | 0.09 |

| Travelers | $34,296,597 | 4 | 0.12 |

| State Farm | $1,104,995,851 | 139 | 0.13 |

| Motorists Mutual | $87,339,587 | 12 | 0.14 |

| Western Reserve | $39,856,847 | 6 | 0.15 |

| Central Mutual Insurance | $26,100,832 | 4 | 0.15 |

| Erie Ins | $165,635,470 | 27 | 0.16 |

| Progressive | $735,856,590 | 132 | 0.18 |

| Allstate | $518,990,474 | 93 | 0.18 |

| Nationwide | $502,214,954 | 89 | 0.18 |

| USAA | $128,451,418 | 24 | 0.19 |

| Safeco | $136,514,043 | 27 | 0.20 |

| Grange Ins | $284,220,966 | 61 | 0.21 |

| Liberty Mutual | $104,345,242 | 22 | 0.21 |

| Standard | $24,131,254 | 5 | 0.21 |

| State Auto Mutual | $63,416,973 | 14 | 0.22 |

| The Hartford | $26,858,803 | 6 | 0.22 |

| Ohio Mutual | $37,387,215 | 9 | 0.24 |

| Farmers | $91,003,376 | 22 | 0.24 |

| Ocean Harbor Casualty Insurance Company | $24,019,043 | 9 | 0.37 |

| Amerian Family | $131,678,210 | 50 | 0.38 |

| Metlife | $23,650,232 | 9 | 0.38 |

| Geico | $304,174,585 | 127 | 0.42 |

| Esurance | $40,101,143 | 19 | 0.47 |

| Alfa Ins | $28,495,860 | 33 | 1.16 |

| Safe Auto | $62,322,596 | 94 | 1.51 |

What do we recommend?

We want you to use all of our data and analysis to make the best car insurance decision possible. That being said, you should pick a provider that has done well in multiple categories. Erie and Westfield Insurance are examples of this because they both scored in the top three for premium pricing and in the top ten for popularity and customer service.

If you’re planning to move to Ohio, pay special attention to our cheapest car insurance by city feature. Rates can vary wildly by city – you could get a much higher car insurance quote in Dayton, OH than in Parma, for example.

If you still have questions, there are insurance agents who can help. Give them a call at now to find answers to your questions or help finding the cheapest car insurance rates.

Where We Found The Facts

We did a lot of research to make this page possible. The one thing that might not work for you though are the premiums. While we use real driver profiles based on people who drive a 2013 Honda Civic LX (4-door) and have good credit and no accidents, your rates will be different unless this matches exactly.

Source Links:

- Ratekick.com