Oregon Car Insurance Uncovered

On the hunt for car insurance info? You’ve come to the right place. Don’t spend time researching we’ve done all the work for you. If you’re looking for car insurance in The Beaver State, this page is for you.

What Are You Looking For?

- Oregon’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Oregon Car Insurance Providers

- Customer Satisfaction Ratings

- Our Recommendation

Who are Oregon’s Cheapest Providers?

Depending on what kind of driver you are, where you live, how old you are, marital status, credit scores, and a lot of other information, there are different rates for drivers for their car insurance. In our search for cheap car insurance, we calculated the average insurance rates for all Oregon drivers based on 10 cities, eight driver profiles, and nine companies. In all of our driver profiles, the driver drives a 2013 Honda Civic LX (4-door), has good credit, 50/100/100 coverage, and no accidents. Our research results indicate that Oregon Mutual offers the cheapest rates, coming in $150 less than American Family, which offered the second most affordable option for auto insurance.

Oregon Mutual, created under the motto “insurance of the people, by the people, and for the people,” only sells in four other states. So while it does have the lowest average cost for auto insurance rates, it may not have the financial backing that comes with more nationally recognized insurance providers such as American Family, Allstate, Travelers, and more.

Take a look to see how much you could pay for car insurance depending on which insurance company you choose.

| Average Quote | |

|---|---|

| Oregon Mutual | $894.95 |

| American Family | $1,045.25 |

| Allstate | $1,311.70 |

| Travelers | $1,395.78 |

| Country Financial | $1,434.85 |

| Farmers | $1,536.70 |

| Geico | $1,551.51 |

| Safeco | $1,909.71 |

| Liberty Mutual | $2,204.00 |

Read More: Country Financial Insurance Review

How much do drivers like you spend on auto insurance?

Car insurance premiums aren’t one-size-fits-all by any means. In fact, insurance companies products are often tailored to be the best fit for certain driver profiles. You’ll be able to project what you’ll spend on car insurance in Oregon better if you look at average rates for people like you. Typically, those who are considered to be a safe driver with no tickets or accidents on their driving record will find themselves with some of the cheapest car insurance rates. Meanwhile, a high-risk driver with many violations will find themselves paying much more than the average driver for an auto insurance policy. Below, find our research on average insurance rates by company for millennials, seniors, Gen X drivers, and more.

Cheapest Car Insurance for Millennials

Young drivers typically pay more for car insurance especially between 18 and 25. We did some calculating to find the cheapest option for car insurance for millennials. Since rates in our research range from $1,200 with Oregon Mutual to over $2,800 with Liberty Mutual, you’ll want to take a look to see if you can save.

| Average Quote | |

|---|---|

| Oregon Mutual | $1,200.40 |

| American Family | $1,444.40 |

| Allstate | $1,777.50 |

| Country Financial | $1,911.20 |

| Geico | $2,138.90 |

| Travelers | $2,171.41 |

| Farmers | $2,367.00 |

| Safeco | $2,795.73 |

| Liberty Mutual | $2,874.13 |

Read more: Liberty Mutual Auto Insurance

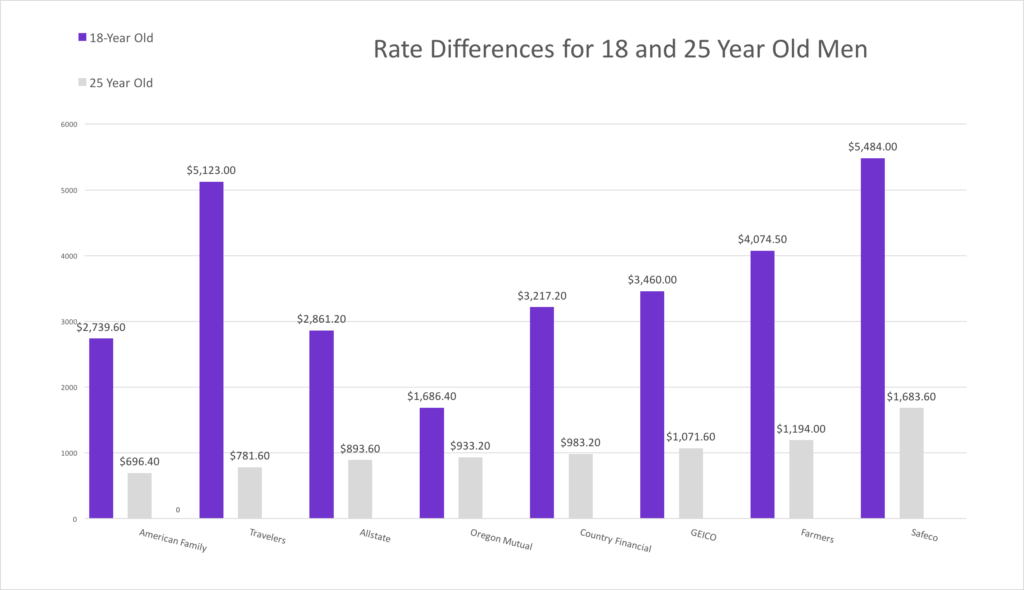

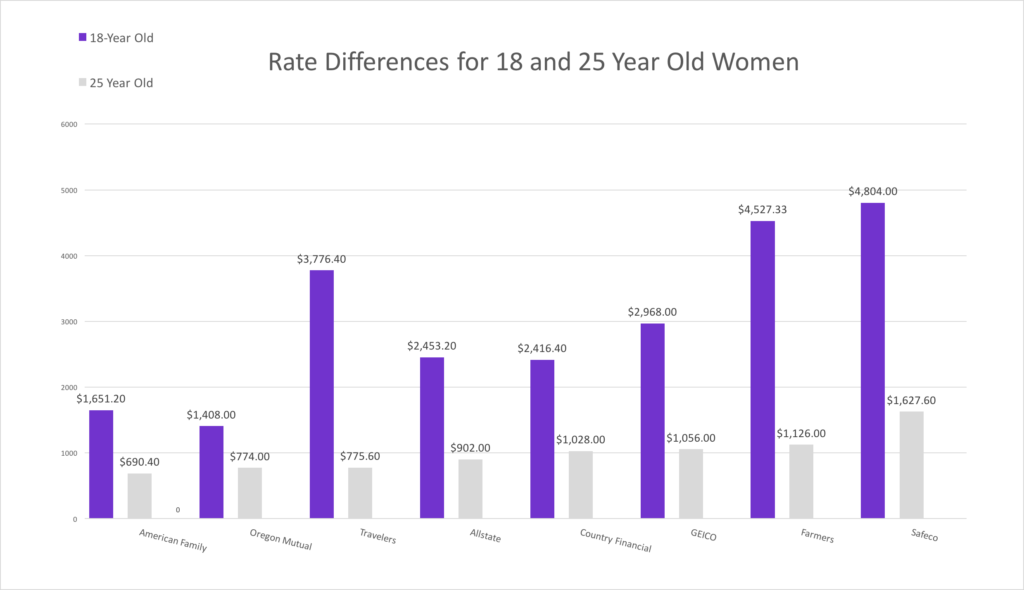

How Rates Change For Drivers As You Age

We just mentioned how rates are most expensive for teen drivers and how premiums tend to go down as you age. From 18 to 25, male drivers can see up to an 85% decrease in car insurance rates! For women, rates drop on average 60% for their insurance policy. This is because statistics show that female drivers get in fewer accidents than their male counterparts in their teens, so rates for teen women aren’t as high at the age of 18. See for yourself how rates drop for young male and female drivers with the insurance companies we studied.

Cheapest for Gen X Drivers

Everyone loves a bargain. Using the annual average car insurance rates provided for 40-year old male and female drivers, we were able to compute the cheapest insurance carriers for Gen X drivers. We found that Oregon Mutual, American Family, and Travelers have the lowest insurance costs, but even Farmers, Allstate, and Country Financial all offer a comparable annual rate.

| Average Quote | |

|---|---|

| Oregon Mutual | $625.00 |

| American Family | $678.00 |

| Travelers | $761.40 |

| Farmers | $790.80 |

| Allstate | $863.20 |

| Country Financial | $962.80 |

| Geico | $1,070.80 |

| Safeco | $1,399.00 |

| Liberty Mutual | $1,781.60 |

*These premiums are based on computing information on 40-year old male and female drivers.

Cheapest For Seniors

We took a look at married men and women who were 60-years old to find the cheapest auto coverage in Oregon. You’ll find that insurance for drivers in this group will be the cheapest car insurance rate when compared to coverage rates for millennials and Gen X drivers.

| Average Quote | |

|---|---|

| Oregon Mutual | $554.00 |

| American Family | $614.20 |

| Farmers | $704.89 |

| Travelers | $711.60 |

| Allstate | $828.60 |

| Geico | $920.55 |

| Country Financial | $954.20 |

| Safeco | $1,091.40 |

| Liberty Mutual | $1,621.20 |

What are specific city rates in Oregon?

What do all drivers in Oregon have in common? The fact that they can’t pump their own gas! But that’s where the similarities end because they even pay different rates for car insurance based on location. Take Salem and Hillsboro for instance. They’re only about an hour apart, but rates differ by almost $400. See what your neighbors might be paying for car insurance with our calculations below.

| Average Quote | |

|---|---|

| Salem | $1,277.94 |

| Eugene | $1,380.70 |

| Medford | $1,399.28 |

| Springfield | $1,436.28 |

| Corvallis | $1,468.86 |

| Beaverton | $1,484.85 |

| Bend | $1,486.06 |

| Gresham | $1,496.00 |

| Portland | $1,554.73 |

| Hillsboro | $1,627.88 |

What are the most popular Oregon car insurance companies?

Market share shows the percentage of customers a company has compared to competitors. You can look at it as a way to find the most popular insurers in Oregon. State Farm currently has the state’s most customers, coming in at nearly a quarter! When choosing an insurance company, it can be smart to see how popular a company is with other customers. Take Oregon Mutual for instance; while it’s the cheapest auto insurance rates consistently, offering the lowest rate doesn’t get them into the top 10 for most popular. There’s usually a good reason why people flock to certain insurance providers, so it could be a good indication of where you might be happiest when it comes to auto insurance companies.

| Market Share Percent | |

|---|---|

| State Farm | 21.17 |

| Farmers | 12.05 |

| Progressive | 10.65 |

| Liberty Mutual | 9.91 |

| Allstate | 8.39 |

| Geico | 7.56 |

| USAA | 4.81 |

| Country Insurance | 3.62 |

| American Family | 3.5 |

| Nationwide | 2.53 |

What about customer satisfaction rating?

A “complaint index” explains the percentage of customer complaints compared to its market share. In other words, it shows how many customers are unhappy with service. The lower numbers are best and anything over 1.0 indicates a worrisome percentage of customer dissatisfaction. Nationwide, Mutual of Enumclaw, and Oregon Mutual Insurance are the best in the state when it comes to a low complaint index. Esurance is the worst of the companies we looked at, but by no means is its margin of complaints terrible.

| Premiums | Complaints | Complaint Ratio per 1,000,000 | |

|---|---|---|---|

| Nationwide | 25,152,561 | 0 | 0 |

| Mutual of Enumclaw | 22,943,142 | 0 | 0 |

| Oregon Mutualurance | 21,769,377 | 0 | 0 |

| Country Ins | 80,815,703 | 2 | 0.02 |

| Farmers | 246,361,090 | 10 | 0.04 |

| State Farm | 484,281,004 | 28 | 0.06 |

| Progressive | 233,907,261 | 16 | 0.07 |

| USAA | 93,391,404 | 7 | 0.07 |

| Allstate | 158,050,858 | 12 | 0.08 |

| American Family | 69,119,502 | 6 | 0.09 |

| The Hartford | 22,536,184 | 2 | 0.09 |

| Ameriprise Financial | 18,433,419 | 2 | 0.11 |

| Geico | 136,398,381 | 15 | 0.11 |

| Safeco | 172,598,411 | 20 | 0.12 |

| Liberty Mutual | 48,267,215 | 6 | 0.12 |

| Esurance | 19,196,747 | 3 | 0.16 |

Just make sure you look at the complaint index before you choose a car insurance company so you can make sure its up to snuff customer service-wise.

What’s our recommendation?

Our only recommendation is that you make the decision that’s right to you after reading all the facts on this page. That, and one more thing: that you go with a car insurance company that’s an all-around champion.

Allstate, American Family, and Country Insurance all ranked in the top five for cheapest premiums and in the top 10 for customer service and market share. Go with a provider like this and you should be in good shape.

If you still need help, give a licensed agent a call. He/she would be happy to walk you through details about Oregon car insurance and help you shop around for quotes.

Where We Found The Facts

We did a lot of number crunching here based on very specific information. While all the rates are accurate for these driver profiles, if you don’t match it completely then your rates will likely differ. We wanted to give you an idea of what you could pay for car insurance in Oregon, but the only way to know for sure is to call and get a custom quote.

Source Links:

- Ratekick.com