Bringing you well-researched, complete, and important auto insurance information is what we’re here to do. If you know everything is bigger in Texas and are proud of your Lone Star State, this page is for you.

What Are You Looking For?

- Texas’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Texas Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are the minimum requirements for car insurance in Texas?

Virginia’s minimum coverage requirements consist of bodily injury liability coverage and property damage liability coverage.

However, for many drivers, the minimum coverage for liability insurance is not enough. It is recommended you add collision coverage and comprehensive coverage to your auto policy to make sure you’re fully covered, and if you’re still paying off your car, your lender may require these coverages. Liability, collision, and comprehensive insurance combined is referred to as a full-coverage policy.

You have a wide range of optional coverage possibilities to consider as well, including uninsured/underinsured motorist coverage, personal injury protection, GAP insurance, and rental reimbursement coverage.

What Are Texas’ cheapest car insurance companies?

We analyzed 25 cities and 10 profiles of sample drivers with minimum liability coverage, no violations, and low annual mileage and 30 insurance companies to find average premiums for average drivers. In Texas, insurance companies only give rates for people over and under 25, so depending on how old you are you could see different rates than the chart below. Regardless, rates usually do drop as you age and do so dramatically after you turn 25. So it’s something to keep in mind when looking at our research into the cheapest car insurance companies.

| Texas' Cheapest Companies | Average Yearly Rate |

|---|---|

| Allianz | $607.14 |

| USAA | $662.89 |

| Auto Club Enterprises | $703.33 |

| Texas Farm Bureau Mutual | $775.61 |

| The Hartford | $801.96 |

| Foremost Insurance | $839.69 |

| Direct General | $880.96 |

| Travelers | $908.59 |

| MetLife | $948.40 |

| 21st Century | $961.25 |

| Kemper | $1,005.48 |

| Farmers | $1,006.82 |

| State Farm | $1,009.22 |

| Amica Mutual | $1,060.87 |

| Safe Auto | $1,135.00 |

| Farm Bureau Of Texas | $1,161.39 |

| Texas Automobile Insurance Plan Association | $1,196.78 |

| Liberty Mutual | $1,210.47 |

| Nationwide | $1,217.59 |

| Geico | $1,280.07 |

| Titan | $1,341.22 |

| AIG | $1,416.02 |

| Allstate | $1,436.87 |

| Loya | $1,512.96 |

| National General | $1,570.84 |

| Infinity | $1,599.34 |

| The General | $1,688.49 |

| Progressive | $1,758.98 |

| Esurance | $2,132.36 |

| Mercury | $2,391.88 |

| Safeco | $2,826.05 |

How much do drivers like you spend on auto insurance coverage?

Every driver will get a different car insurance premium because of age, driving history, and tons of other factors. These are sample quotes. Your unique situation may change the numbers. So it’s important to get your own quotes from different companies to compare the average rate and save. To give you a better idea of what you can expect to pay, we calculated rates for specific groups. Take a look.

Cheapest For Drivers 21 and Under

If you’re a Gen Y driver, we did some research to find the cheapest Texas car insurance companies for your age group. Allianz is by far the cheapest at about $1,500 less expensive than the priciest policy. This is the most expensive age group for insurance. Drivers may have clean driving records, but they lack experience and present a higher risk making it harder to find cheap car insurance. Check out the chart to see where people like you can find some of the cheapest car insurance in the state.

Read more:

- 6 Proven Ways To Save On Auto Insurance

- Texas Auto Insurance For High-Risk Drivers: Providing Coverage

| Average Yearly Rate | |

|---|---|

| Allianz Insurance | $901.72 |

| Auto Club Enterprises | $1,009.52 |

| USAA | $1,030.31 |

| Texas Farm Bureau Mutual | $1,159.14 |

| The Hartford | $1,164.51 |

| Foremost Insurance | $1,202.54 |

| Travelers | $1,279.34 |

| Geico | $1,380.59 |

| 21st Century | $1,425.38 |

| MetLife | $1,461.26 |

| Direct General | $1,495.96 |

| Kemper | $1,506.87 |

| Liberty Mutual | $1,507.02 |

| State Farm | $1,508.13 |

| Amica Mutual | $1,612.26 |

| Farmers | $1,640.16 |

| Texas Automobile Insurance Plan Association | $1,723.16 |

| Farm Bureau Of Texas | $1,735.70 |

| Safe Auto | $1,883.00 |

| Nationwide | $1,905.11 |

| Titan | $2,060.32 |

| AIG | $2,077.98 |

| Allstate | $2,170.13 |

| Loya | $2,293.12 |

| National General | $2,496.77 |

How Rates Fluctuate Between Male And Female Gen Y Drivers

You will most likely see a different car insurance rate than the opposite sex. In Texas, you can see that men pay about 15% more for car insurance than the ladies. All of these averages are based off of our study that looked at profiles of drivers under 25 years old, but take a look at the sample rates for reference.

Some states prohibit insurance companies from offering different rates based on gender. Even in those states, rates can vary between men and women based on driving history and other factors.

| Women's Rates | Men's Rates | |

|---|---|---|

| 21st Century | $904.18 | $1,018.32 |

| AIG | $1,346.18 | $1,485.86 |

| Allianz | $570.58 | $643.69 |

| Allstate | $1,345.70 | $1,528.03 |

| Amica Mutual | $1,027.24 | $1,094.50 |

| Auto Club Enterprises | $677.30 | $729.36 |

| Direct General | $875.80 | $886.12 |

| Esurance | $1,919.50 | $2,345.22 |

| Farm Bureau Of Texas | $1,052.20 | $1,270.58 |

| Farmers | $942.22 | $1,071.42 |

| Foremost Insurance | $790.20 | $889.18 |

| Geico | $1,331.71 | $1,228.43 |

| Infinity | $1,511.64 | $1,687.04 |

| Kemper | $924.04 | $1,086.92 |

| Liberty Mutual | $1,194.38 | $1,226.56 |

| Loya | $1,339.28 | $1,686.64 |

| Mercury | $2,211.60 | $2,572.16 |

| MetLife | $870.60 | $1,026.20 |

| National General | $1,477.33 | $1,664.35 |

| Nationwide | $1,091.03 | $1,344.15 |

| Progressive | $1,663.63 | $1,854.32 |

| Safe Auto | $1,096.44 | $1,173.56 |

| Safeco | $2,626.90 | $3,025.20 |

| State Farm | $913.52 | $1,104.91 |

| Texas Automobile Insurance Plan Association | $1,089.56 | $1,304.00 |

| Texas Farm Bureau Mutual | $702.74 | $848.48 |

| The General | $1,579.18 | $1,797.80 |

| The Hartford | $778.02 | $825.90 |

| Titan | $1,207.14 | $1,475.29 |

| Travelers | $836.54 | $980.64 |

| USAA | $629.19 | $696.59 |

Read more: Allianz Auto Insurance

Cheapest For Drivers Over 25

To find these averages, we took information from men and women who were single, married, and over 25. It’s clear to see the drop in rates from the under 25-category (Gen Y).

| Average Yearly Rate | |

|---|---|

| Direct General | $265.96 |

| USAA | $295.47 |

| Allianz | $312.55 |

| Farmers | $373.48 |

| Safe Auto | $387.00 |

| Texas Farm Bureau Mutual | $392.08 |

| Auto Club Enterprises | $397.14 |

| MetLife | $435.54 |

| The Hartford | $439.41 |

| Foremost Insurance | $476.84 |

| Progressive | $495.50 |

| 21st Century | $497.12 |

| Kemper | $504.09 |

| Amica Mutual | $509.48 |

| State Farm | $510.30 |

| Nationwide | $530.07 |

| Travelers | $537.84 |

| Safeco | $568.46 |

| Farm Bureau Of Texas | $587.08 |

| Infinity | $607.72 |

| Titan | $622.11 |

| Mercury | $631.24 |

| National General | $644.91 |

| Texas Automobile Insurance Plan Association | $670.40 |

| Allstate | $703.61 |

| The General | $708.62 |

| Loya | $732.80 |

| AIG | $754.06 |

| Esurance | $826.86 |

| Liberty Mutual | $913.92 |

| Geico | $1,179.55 |

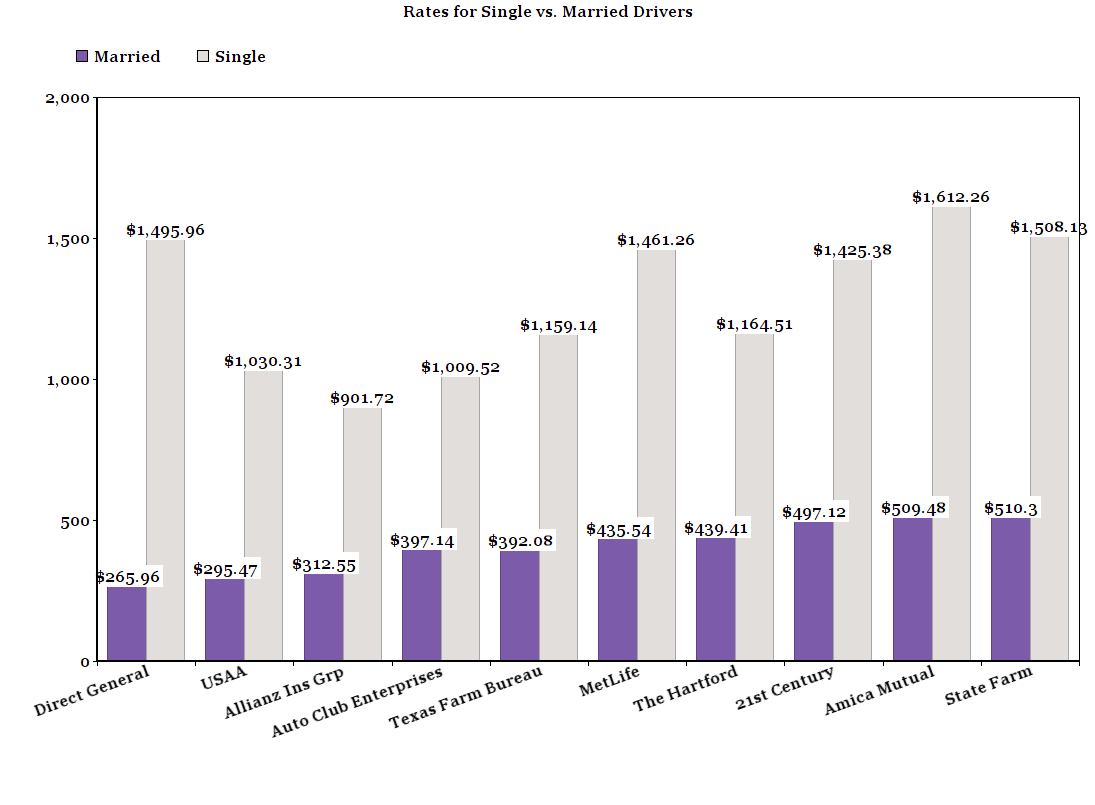

Cheapest For Single Drivers

Single drivers pay more than married drivers. This could be because married people are more stable. In many cases, However, we did the research to find the cheapest car insurance for your demographic. See graph below.

Cheapest For Married Couples

Married couples also have some of the lowest rates compared to single and drivers under 25. Starting at just around $265, take a look to see where your age bracket might be able to find the cheapest auto rates in Texas.

In addition to age, gender, and marital status, car insurance companies factor your credit score and driving record into your premium. If you have a poor credit history or bad driving record, make sure to ask about insurance discounts when you’re shopping for auto insurance quotes. Major insurers offer opportunities to save like the good student discount, safe driver discount, and the discount for taking a defensive driving course. You may also get a discount for bundling two types of insurance, like an auto insurance policy and a homeowners insurance policy. Discounts like these can significantly bring down your insurance costs.

Read more:

- Finding The Best Auto Insurance For Married Couples

- What You Need To Know About Auto Insurance Costs In Texas

What are average rates in the cities?

Depending on whether you live in El Paso or Houston, you could see up to a 23% difference in auto insurance rates. That’s based on our research, but it’s a trend across the board when looking at other states too.

Insurance companies look at factors like crime rate, claim (or accident) rate, and other things that may increase the likelihood of a claim. All this varies by your city and neighborhood within the city. Rates on auto insurance policies can vary just as widely.

For comparative purposes, check out the chart below to see what your neighbors in Texas are paying for car insurance and what you might too.

| Price by City | Average Yearly Rate |

|---|---|

| El Paso | $1,011.88 |

| Waco | $1,034.20 |

| Killeen | $1,048.06 |

| Georgetown | $1,071.53 |

| Lubbock | $1,086.93 |

| San Marcos | $1,096.96 |

| Laredo | $1,106.05 |

| College Station | $1,106.61 |

| Waxahachie | $1,159.89 |

| Austin | $1,185.96 |

| Pearland | $1,202.52 |

| Tyler | $1,210.64 |

| Arlington | $1,217.86 |

| Fort Worth | $1,218.46 |

| Montgomery | $1,222.49 |

| San Antonio | $1,240.34 |

| Denton | $1,248.52 |

| Corpus Christi | $1,278.30 |

| Galveston | $1,306.96 |

| Brownsville | $1,314.41 |

| Dallas | $1,334.22 |

| Beaumont | $1,379.53 |

| Fort Bend | $1,389.39 |

| McAllen | $1,408.78 |

| Houston | $1,416.71 |

In Texas, insurance rates don’t always rise with city size. For example, average car insurance rates in Corpus Christi, Texas are higher than those in Austin.

Read more: Finding Affordable Homeowners Insurance In Austin

What are the most popular Texas car insurance providers?

Market share shows the percentage of customers a company has compared to competitors. In Texas, State Farm has the most customers at almost 20%.

When you’re looking for an auto insurance provider, it’s important to study facts like these because normally when a lot of customers are doing business with a company, you can trust that there’s something they all like about it more than others.

This is true whether you have a clean driving record or a few tickets. Of course, there is no insurer that takes up the entire market share because people have different priorities and preferences. If you have more questions about individual carriers, you can talk to an independent agent or customer service to find answers.

| Premiums Written | Market Share | |

|---|---|---|

| State Farm | 3,043,741 | 18.66 |

| Allstate | 1,875,832 | 11.5 |

| Farmers | 1,646,063 | 10.09 |

| Geico | 1,493,926 | 9.16 |

| Progressive | 1,427,038 | 8.75 |

| USAA | 1,243,538 | 7.62 |

| Home State Insurance | 612,610 | 3.76 |

| Texas Farm Bureau Mutual | 606,959 | 3.72 |

| Nationwide | 530,879 | 3.25 |

| Liberty Mutual | 473,741 | 2.9 |

Which insurers have the highest customer satisfaction ratings?

A “complaint index” records the percentage of customer complaints compared to a company’s market share. Zero is a very good score since it means little to no people are complaining. Anything over 1.0 is a little concerning. In general, you’ll want to stick with an auto insurance company like Markel or Travelers that have low complaint indexes. It’ll give you better odds of getting customer service and enjoying your experience with that company.

| # Of Complaints | # of Policies Written | Complaint Ratio | |

|---|---|---|---|

| Markel Insurance | 0 | 29931 | 0 |

| WR Berkley | 0 | 26991 | 0 |

| Allianz | 0 | 26535 | 0 |

| Central Mutual Insurance | 0 | 19901 | 0 |

| Travelers | 0 | 15656 | 0 |

| Philadelphia Indemnity | 0 | 13661 | 0 |

| Assurant | 0 | 13560 | 0 |

| Standard Fire | 0 | 13496 | 0 |

| Selective Insurance | 0 | 4775 | 0 |

| Falcon Insurance | 0 | 4272 | 0 |

| Amtrust | 0 | 3659 | 0 |

| PURE | 0 | 3359 | 0 |

| AIG | 0 | 2833 | 0 |

| Hanover | 0 | 2772 | 0 |

| Allied | 0 | 2583 | 0 |

| Church Mutual | 0 | 2338 | 0 |

| Utica National | 0 | 1932 | 0 |

| Electric Insurance | 0 | 1842 | 0 |

| Great Lakes | 0 | 1752 | 0 |

| NBIS Group | 0 | 1632 | 0 |

| GuideOne | 0 | 1399 | 0 |

| Cuna Mutual | 0 | 1205 | 0 |

| Catlin | 0 | 1158 | 0 |

| Delek Group | 0 | 1118 | 0 |

| Amica Mutual | 2 | 67039 | 0.03 |

| Texas Farm Bureau | 12 | 361892 | 0.03 |

| State Farm | 136 | 3461354 | 0.04 |

| Dairyland | 7 | 137446 | 0.05 |

| Tiptree Insurance | 2 | 38957 | 0.05 |

| American National | 2 | 37192 | 0.05 |

| Farmers | 56 | 1021277 | 0.05 |

| USAA | 49 | 724285 | 0.07 |

| Horace Mann | 2 | 27460 | 0.07 |

| Germania | 8 | 107974 | 0.07 |

| Allstate | 78 | 1041971 | 0.07 |

| Progressive | 71 | 948003 | 0.07 |

| Federated Mutual Group | 1 | 12777 | 0.08 |

| QBE Insurance | 16 | 191501 | 0.08 |

| Geico | 82 | 925476 | 0.09 |

| Safeway | 2 | 19731 | 0.10 |

| Zurich | 27 | 249306 | 0.11 |

| The Hartford | 2 | 17797 | 0.11 |

| Nationwide | 6 | 52525 | 0.11 |

| Mercury | 4 | 34325 | 0.12 |

| Esurance | 5 | 42221 | 0.12 |

| Chubb | 2 | 15846 | 0.13 |

| 21st Century | 5 | 36364 | 0.14 |

| CEM | 9 | 65046 | 0.14 |

| State Auto Mutual | 4 | 28588 | 0.14 |

| Safeco | 3 | 21284 | 0.14 |

| Anchor Insurance | 1 | 6216 | 0.16 |

| Loya Insurance | 27 | 162087 | 0.17 |

| Direct General | 4 | 21580 | 0.19 |

| ACCC Insurance | 77 | 410477 | 0.19 |

| Liberty Mutual | 38 | 201915 | 0.19 |

| Munich RE Group | 7 | 35218 | 0.20 |

| Kemper Corporation | 10 | 49379 | 0.20 |

| Carolina Motor Club | 1 | 4783 | 0.21 |

| Infinity | 10 | 41975 | 0.24 |

| MGA | 15 | 59628 | 0.25 |

| Metlife | 8 | 27748 | 0.29 |

| Affirmative Insurance | 21 | 64910 | 0.32 |

| Orpheus | 99 | 301321 | 0.33 |

| National General | 8 | 22403 | 0.36 |

| Hallmark | 8 | 20615 | 0.39 |

| IDS | 7 | 17146 | 0.41 |

| American Access | 21 | 48663 | 0.43 |

| IAT Reins | 3 | 6833 | 0.44 |

| California Casualty | 1 | 1951 | 0.51 |

| American Family | 7 | 13415 | 0.52 |

| State Auto | 1 | 1762 | 0.57 |

| Elephant Insurance | 16 | 26341 | 0.61 |

| Safe Auto | 6 | 8395 | 0.71 |

| Knightbrook | 3 | 4017 | 0.75 |

| EMC | 1 | 1207 | 0.83 |

| Arch Insurance | 2 | 2112 | 0.95 |

| Old Republic Group | 2 | 1844 | 1.08 |

| American International Group | 2 | 1215 | 1.65 |

Read more: Providing Reliable Kemper Insurance Reviews

Which insurance company is the best?

We want you to use all of our data and research to make the best auto insurance decision for yourself. We can offer up some advice though: choose a company that’s great across multiple categories.

State Farm is an example of an all-around great car insurance provider because it ranks in the top for average premiums, market share, and low complaint index. Go with a company like this and you should be in good shape.

Your choice will often depend on what you need. Are you looking to meet the minimum car insurance requirements, or do you want more comprehensive coverage? Are you looking for coverage for the whole family? Do you also own a home or need other insurance policies? Are you looking for a carrier who can cover poor credit situations? Are you looking for the most affordable auto insurance?

Different insurance companies also offer different discounts such as good student discounts for teens and defensive driving classes. Whatever your goals, the best thing to do is get multiple insurance quotes to compare your options.

How did we find our information?

All of the information here is based on research and analysis. The premiums are accurate for the groups we ran numbers for, but unless you match those 100%, you will probably get a different premium. The reason we provided annual rates is to give you a good idea of what you could pay for car insurance in Texas.

Source Links:

- https://www.iii.org/publications/a-firm-foundation-how-insurance-supports-the-economy/a-50-state-commitment/insurance-companies-by-state

- https://apps.tdi.state.tx.us/helpinspublic/Start.do?type=auto