Even car insurance can be “for lovers.” On this page, you’ll find everything you need to know as an insured driver in Virginia from the cheapest rates by insurance company to the most popular auto insurance companies. If you live anywhere from the coast of Virginia Beach to the Blue Mountains of western Virginia, this car insurance information is for you.

Get a Quote from Top Companies

What Are You Looking For?

- Virginia’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Virginia Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are the minimum requirements for coverage in Virginia?

Virginia’s minimum coverage requirements consist of bodily injury liability coverage and property damage liability coverage.

However, for many drivers, the minimum coverage for liability insurance is not enough. It is recommended you add collision coverage and comprehensive coverage to your auto policy to make sure you’re fully covered, and if you’re still paying off your car, your lender may require these coverages.

You have a wide array of additional coverage options to consider as well, including uninsured/underinsured motorist coverage, personal injury protection, GAP insurance, and roadside assistance coverage.

What are Virginia’s cheapest car insurance companies?

To find the cheapest car insurance companies in Virginia, we took information from three driver profiles, six cities, and based their coverage off of having the state minimums. Since Virginia has so many veterans about 781,000 it makes sense that USAA offers some of the cheapest auto coverage options based on average cost. Take a look to see where an average driver in Virginia may be able to find the cheapest rates.

| Cheapest Companies in Virginia | Average Annual Rate |

|---|---|

| USAA | $1,767.26 |

| Erie | $2,187.33 |

| Amtrust | $2,414.17 |

| Geico | $2,417.64 |

| Virginia Farm Bureau | $2,435.42 |

| State Farm | $2,442.03 |

| Travelers | $2,620.39 |

| Allstate | $2,659.28 |

| Progressive | $2,663.19 |

| Nationwide | $3,002.92 |

| Liberty Mutual | $3,338.67 |

Read more:

- Comparing USAA And Progressive

- Comparing Auto Insurance Providers: Allstate, Geico, Progressive, And State Farm

How much do drivers like you spend on auto insurance?

To help you find more accurate premium predictions, we calculated annual average rates by driver type. Check out the section below to find cheap car insurance if you’re a young, married, or senior driver.

Cheapest For Drivers Under 25

Based on 20-year old single male and female drivers, we found the cheapest average annual car insurance premiums for this young group. USAA is the cheapest yet again, followed closely by Erie. For comparative purposes, check out the average rates below.

| Average Annual Rate | |

|---|---|

| USAA | $2,128.33 |

| Erie | $2,783.92 |

| Geico | $2,869.90 |

| State Farm | $2,951.42 |

| Travelers | $2,985.58 |

| Virginia Farm Bureau | $3,289.26 |

| Liberty Mutual | $3,822.92 |

| Progressive | $3,917.89 |

| Allstate | $3,937.67 |

| Nationwide | $4,001.00 |

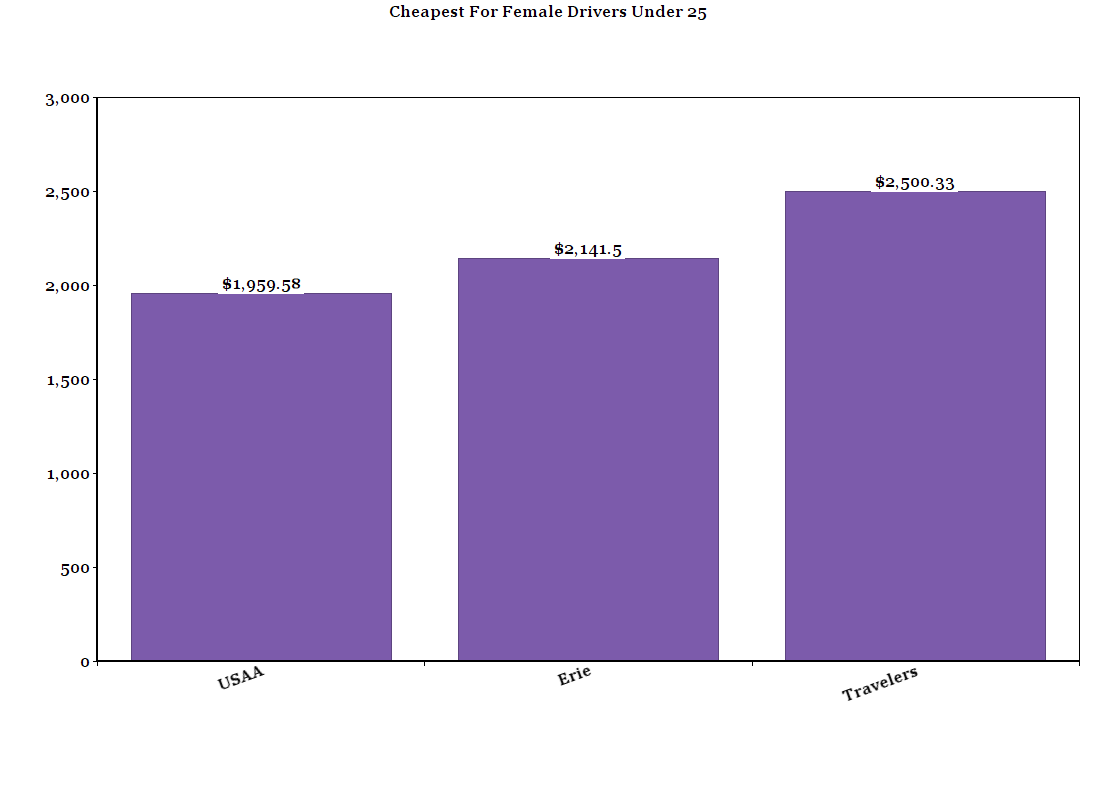

Cheapest Rates For Female Drivers Under 25

Women pay about 15% less for car insurance than their male peers. Based on our calculations, you can also find some of Virginia’s cheapest auto coverage rates from the following providers:

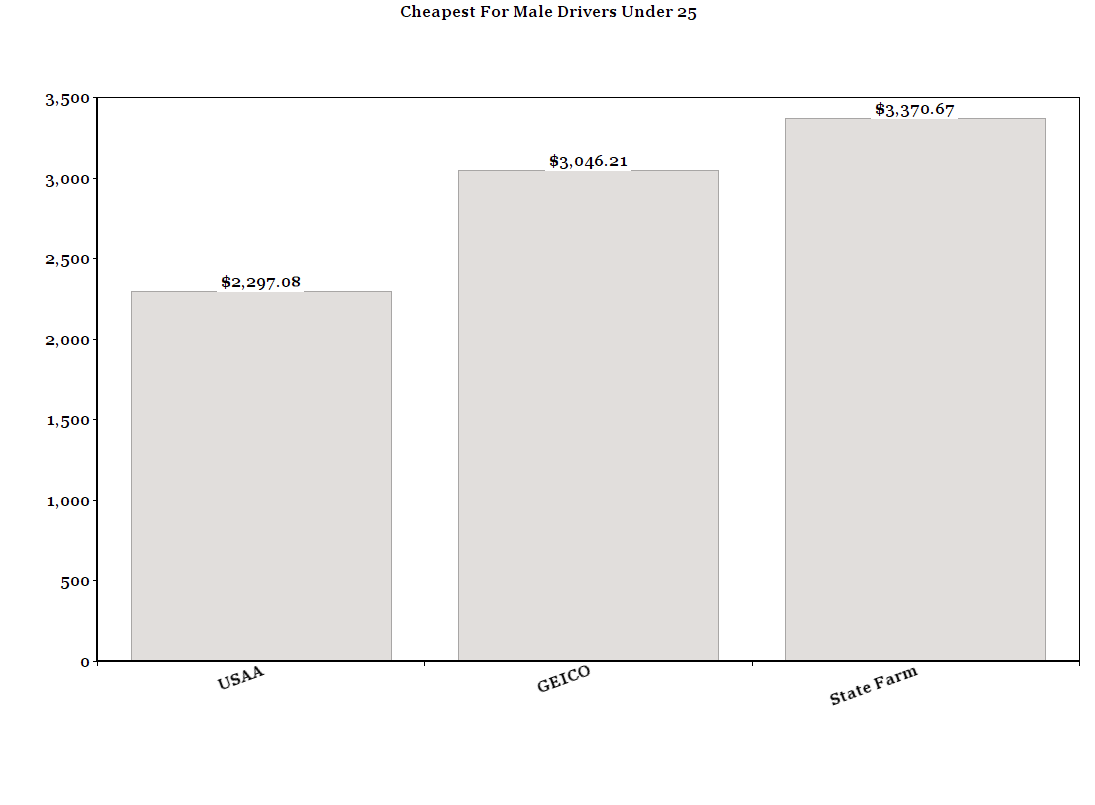

Young male drivers pay about 15% more on car insurance than females their age. Despite this, we’ve done the math to find the cheapest options for your age group in Virginia.

After taking driver profiles of 45-year old married men and women, we calculated annual car insurance premiums. Here’s where we found the cheapest coverage for your demographic:

| Average Annual Rate | |

|---|---|

| Erie | $994.17 |

| USAA | $1,045.13 |

| Virginia Farm Bureau | $1,083.50 |

| State Farm | $1,423.25 |

| Geico | $1,528.20 |

| Travelers | $1,890.00 |

| Allstate | $2,020.08 |

| Progressive | $2,035.83 |

| Liberty Mutual | $2,370.17 |

| Amtrust | $2,414.17 |

| Nationwide | $2,559.33 |

In addition to age, gender, and marital status, car insurance companies factor your credit rating and driving record into your premium. If you have a poor credit history or bad driving record, make sure to ask about insurance discounts when you’re shopping for cheap auto insurance. Major insurers offer auto insurance discounts like the good student discount, safe driver discount, and the discounts for taking a defensive driving course and setting up automatic payments. You may also get a multi-policy discount for bundling two types of insurance, like an auto insurance policy and a homeowners insurance policy. Discounts like these can significantly bring down your insurance costs.

Also, ask your prospective insurance provider if they have an accident forgiveness program, as this can save you money down the line if you get into an auto accident.

What are average rates in the cities?

From the mountains to the beach, you’ll find different auto insurance rates in Virginia. According to our research, the highest are in Norfolk and the lowest can be found in Roanoke. Look at the table below to see what you and your fellow Virginians could pay for car insurance depending on where you live.

| Cost by City | Average Annual Rate |

|---|---|

| Roanoke | $2,249.12 |

| Richmond | $2,364.17 |

| Alexandria | $2,386.63 |

| Virgina Beach | $2,388.44 |

| Charlotte | $2,519.74 |

| Norfolk | $2,565.97 |

What are the most popular Virginia car insurance companies?

Market share shows the percentage of customers an insurance provider has compared to its rivals. State Farm is the auto insurance provider of choice in Virginia with nearly 20% of all insured drivers on their policies. Travelers has one of the smallest market shares in the state.

The important thing to do with this information is to consider why the most customers are opting for a certain insurer. It could be that they have great coverage, pricing, and customer service. Just think about it as you go down the list of top auto insurance providers in Virginia based on market share.

| Market Share | |

|---|---|

| State Farm | 17.17 |

| Geico | 16.27 |

| USAA | 12.77 |

| Allstate | 10.13 |

| Nationwide | 9.51 |

| Progressive | 8.32 |

| Erie | 3.53 |

| Liberty Mutual | 3.25 |

| Virginia Farm Bureau | 2.29 |

| Travelers | 1.88 |

What companies have the best customer satisfaction?

A “complaint index” depicts the percentage of customers who complain compared to the amount an insurance company has. Low numbers indicate less complaints. High numbers mean people are complaining more. Northern Neck Insurance Company has the best complaint index in Virginia which means you can assume they are good at customer satisfaction. Elephant Auto has the worst, but 1.2 isn’t a terrible complaint index to have. If you’re concerned about customer service, look at the chart and choose an auto insurance provider with a low complaint index.

| Complaint Ratio per 1,000,000 in Premiums | |||

|---|---|---|---|

| Premiums Written | # of Complaints | ||

| Northern Neck Insurance Company | $14,690,278 | 0 | 0 |

| Virginia Farm Bureau | 102,147,111 | 1 | 0.01 |

| Farmers | 35,791,022 | 3 | 0.08 |

| Erie Insurance | 160,015,448 | 15 | 0.09 |

| Nationwide | 396,846,371 | 40 | 0.10 |

| Allstate | 427,588,268 | 52 | 0.12 |

| State Farm | 809,251,036 | 109 | 0.13 |

| Progressive | 382,932,189 | 53 | 0.14 |

| USAA | 601,932,737 | 88 | 0.15 |

| MetLife | 19,909,956 | 3 | 0.15 |

| Geico | 767,018,054 | 139 | 0.18 |

| Travelers | 56,441,120 | 12 | 0.21 |

| Esurance | 32,772,163 | 8 | 0.24 |

| Liberty Mutual | 137,708,820 | 36 | 0.26 |

| Victoria Insurance | 28,935,535 | 8 | 0.28 |

| Donegal Insurance Group | 20,839,888 | 6 | 0.29 |

| Rockingham Group | 14,397,820 | 5 | 0.35 |

| Amica | 16,293,778 | 6 | 0.37 |

| Direct General | 15,799,200 | 6 | 0.38 |

| National General | 71,543,771 | 32 | 0.45 |

| Agency Insurance Company | 25,044,490 | 15 | 0.60 |

| Alfa | 79,050,893 | 52 | 0.66 |

| Hartford | 22,494,068 | 21 | 0.93 |

| Elephant Auto Insurance | 37,567,019 | 45 | 1.20 |

What do we recommend?

This data and research we’ve compiled and calculated for you is here to help you make the smartest insurance choice for yourself. We advise you to go with a company that isn’t just great in one category, but across the board.

Erie, USAA, and Virginia Farm Bureau are all great examples of this. They scored in the top ten for market share, cheap pricing, and customer service.

If you still need some help deciding, let our experts assist you. They know everything there is to know about Virginia car insurance and can answer questions or help you shop for quotes. Call an insurance agent today for help finding the most affordable car insurance rates.

Where We Found The Facts

All of the facts here are true and so are the numbers. They might not be accurate for your life though. Since we used such a specific set of data to calculate these average premiums, if you don’t match that profile entirely, you’ll most likely get a different rate. These numbers are merely here to give you an idea of what people like you pay for auto insurance in Virginia.

Source Links:

- Virginia Department of Insurance

- Valuepenguin.com